November's numbers are in and the Bainbridge Island real estate market inventory continues to wane, as the number of active listings was down nearly 20% month-over-month. Sales also decreased, as the number of units sold was down nearly 30% compared to October's numbers. Given the anemic inventory, however, the median listing price increased $90K from the previous year to $875K. And buyers made their presence felt as the median sale price of $690K was up over $175K compared to last year. Along with increased prices, homes sold in an average of just 23 days on the market, down 62% from the previous year.

Global Ultra Wealthy Population Hold Nearly US $3 Trillion in Owner-Occupied Residential Real Estate Assets; Seattle: “Emerging as a Global City” say Local Expert

Nearly US$3 trillion of the world’s private wealth is held in owner-occupied residential properties, a value greater than the GDP of India, a new report by Wealth-X and the Sotheby’s International Realty® brand released yesterday showed. Meanwhile, Seattle-based affiliate Realogics Sotheby’s International Realty says a wave of foreign-direct investment and immigration has arrived to the Pacific Northwest as an alternative to traditional West Coast gateway markets.

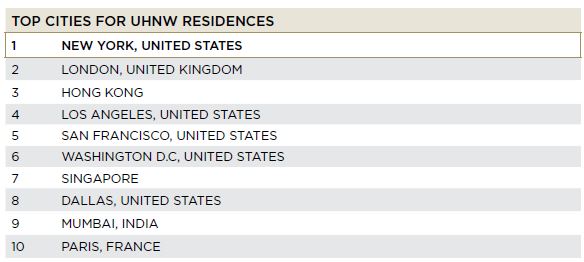

There are 211,275 ultra-high net worth (UHNW) individuals – defined as those with US$30 million and above in net assets – in the world and 79% of them own two or more residences. Some of the main hubs for luxury residential real estate are New York City, London and Hong Kong, but niche locations – such as Lugano, the Hamptons outside New York City, and rural areas around the world – are gaining in popularity.

“We know that some secondary markets have become a primary focus for many savvy overseas investors – they target and help to create the next global cities,” says Dean Jones, President and CEO of Seattle-based Realogics Sotheby’s International Realty. “The Seattle/Bellevue metro area has gained favor as a destination for UHNW, especially those from Mainland China. They prefer the close proximity to Asia, relative affordability compared with other top-tier cities and a high quality of life without a state income tax.”

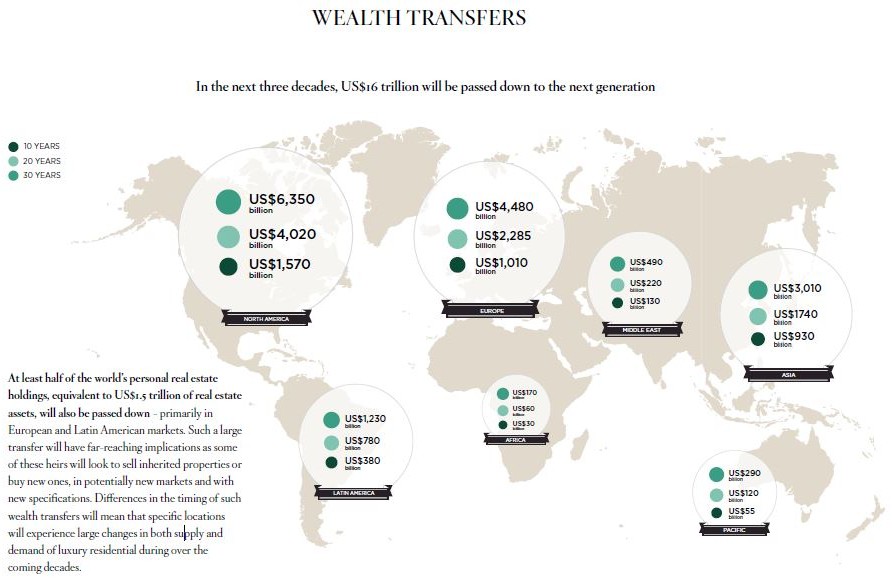

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report forecasts that the ongoing shift in the wealth creation cycle from the West to the East, and the growing significance of inter-generational wealth transfers will have significant consequences on the luxury residential real estate market – with a noted emphasis on new developments and a change in investment grade cities.

“We know that some secondary markets have become a primary focus for many savvy overseas investors – they target and help to create the next global cities,” says Dean Jones, President and CEO of Seattle-based Realogics Sotheby’s International Realty. “The Seattle/Bellevue metro area has gained favor as a destination for UHNW, especially those from Mainland China. They prefer the close proximity to Asia, relative affordability compared with other top-tier cities and a high quality of life without a state income tax.”

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report forecasts that the ongoing shift in the wealth creation cycle from the West to the East, and the growing significance of inter-generational wealth transfers will have significant consequences on the luxury residential real estate market – with a noted emphasis on new developments and a change in investment grade cities.

Below are other key findings from the inaugural report:

- The value of UHNW-owned residential real estate assets increased by 8% globally in 2014.

- On average, UHNW individuals own 2.7 owner-occupied residences.

- As of 2014, over 7% of the world’s UHNW population made their wealth through real estate, up from 5% in 2013.

- Ultra affluent women value real estate assets more than their male counterparts, holding 16% of the net worth in such assets, on average, compared to less than 10% for men.

- Luxury residential real estate is an asset class typically favored by UHNW individuals with inherited wealth: these individuals hold 17% of their net worth in such assets, compared to just under 9% for self-made UHNW individuals.

- UHNW individuals with net worth between US$30 million and US$50 million typically keep their primary residences for over 15 years and their secondary residences for over 10 years.

- Billionaires change one of their four properties, on average, once every three years.

- Secondary residences are typically 45% more valuable than primary residences; twice the square footage and have 10 acres of land.

- At 83%, Monaco has the highest density of foreign-owned UHNW residences.

- Over 6% of the world’s UHNW population have relocated their primary residence to a different country from which they were born – these individuals often keep a secondary residence in their home countries, and India is the leading country in this respect.

The Wealth-X and Sotheby’s International Realty Global Luxury Residential Real Estate Report 2015, which looks at trends in the UHNW population’s appetite for luxury residential real estate across the world, identifies specific attitudes, behaviors and locations that matter to this industry and this wealth segment.

Wealth-X President David Friedman commented: “Wealth-X is pleased to partner with the Sotheby’s International Realty brand for this inaugural report, which underscores Wealth-X’s commitment to conducting groundbreaking research on the world’s ultra-high net worth (UHNW) population. Expert commentary from the Sotheby’s International Realty team complements Wealth-X’s global intelligence on the world’s UHNW population, producing a report that demonstrates a true collaboration between the world’s leading UHNW intelligence provider and the global leader in luxury residential real estate. Luxury residential property is a core component to the anatomy of the ultra-affluent at the intersection of their lifestyle and investment.”

“We are proud to partner with Wealth-X to provide valuable insights into today’s luxury real estate market and the buying behaviors of the ultra-high net worth consumer,” says Philip White, president and chief executive officer, Sotheby’s International Realty Affiliates LLC. “We believe that a solid investment in real estate is one of the single best factors for building long-term wealth, and that many of today’s ultra-high net worth consumers would agree.”

Download the above-referenced report here.

A previous Luxury Lifestyle Report published by Sotheby’s International Realty with reference by Dean Jones on the portrait of an affluent Chinese consumer can be found here.

About Wealth-X: Wealth-X is the world’s leading ultra-high net worth (UHNW) intelligence and prospecting firm with the largest collection of curated research on UHNW individuals, defined as those with net assets of US$30 million and above. Headquartered in Singapore, it has 13 offices on five continents.