According to a new study released by Wealth-X and the Sotheby’s International Realty® brand, more and more ultra high net worth (UHNW) individuals are buying second homes outside of their domiciles. The report revealed that there are currently more than 211,000 UHNW individuals around the world and that their purchase of international homes has risen. “Our partnership with Wealth-X has proven to be invaluable as we continue to explore the motivations of the world’s ultra high net worth,” said Philip White, president and chief executive officer of Sotheby’s International Realty Affiliates, LLC. “The research from our latest report uncovers current trends in home purchasing behavior and chief lifestyle considerations, helping us gain insight into investment strategies of the UHNW population.”

As the report reads, “five years ago international homes accounted for 11% of non-primary UHNW residences, whereas they now account for 16%.” Further, “nearly 80% of UHNW individuals own at least 2 homes and over half own at least 3 homes.”

According to the report, “while many of these homes are being purchased in traditional UHNW centers, additional home buying is becoming a truly global enterprise.” The image below spotlights “the top 10 secondary residence countries, outside primary business country”:

Realogics Sotheby’s International Realty (RSIR) has emphasized the importance of Chinese international buyers for the last few years. Among their many initiatives, RSIR most recently announced a partnership with Tiger Oak Publications on an all-Mandarin magazine, “Seattle Luxury Living,” to target affluent Chinese consumers both locally and overseas. In addition, they launched a “Fly and Buy” luxury tourism program and are developing an exclusive We Chat App that will feature the Seattle Luxury Living content as well as other market reports, featured listings and reference resources for Mandarin-speaking homebuyers exploring investment in the Pacific Northwest. Read more about the firm’s initiatives >>

Other key findings from the report:

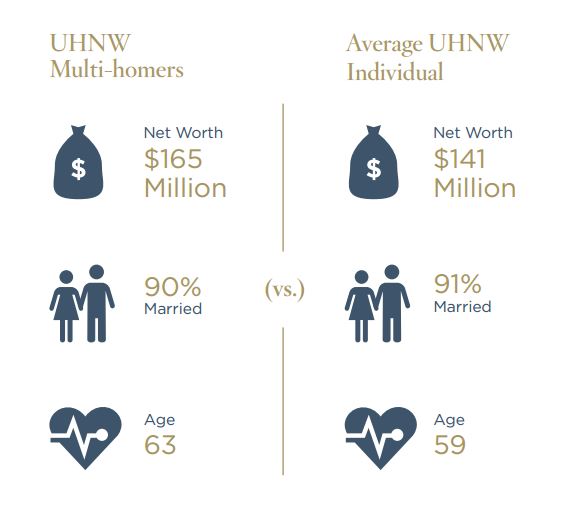

- The average UHNW Mult-homer is 63 years old, has a net worth of US$165 million and is married.

- The United States is the most popular location for second homes among the ultra wealthy, followed by the United Kingdom and Switzerland.

- Four types of luxury home types have emerged as favorites among the global ultra wealthy: Green Homes, Smart Homes, Private Islands, and Serviced Apartments. These types of luxury residences serve their needs, aspirations, and lifestyle considerations.

- The Caribbean and the Mediterranean remain favorites among UHNW buyers for private island homes, but Southeast Asia, Canada, Belize and the United Kingdom are gaining popularity.

- UHNW Multi-home buyers are fueling market growth in regions beyond urban hubs such as London, New York City and Hong Kong. The report profiles Miami, Florida; Geneva, Switzerland; and Long Island, New York.

Read the Full Wealth-X & Sotheby’s International Realty Report >>